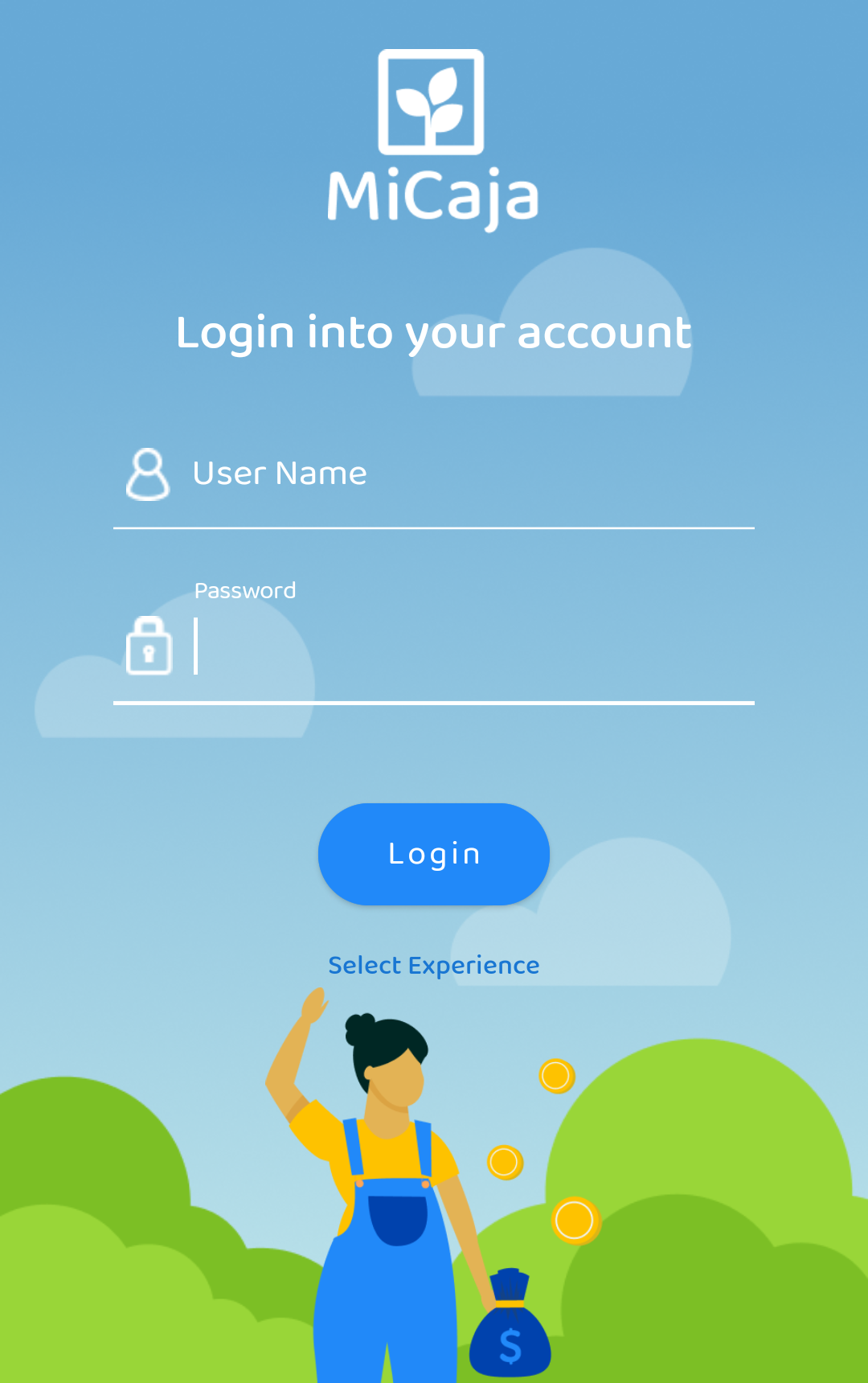

The app is built on the Java programming language, Mi-caja leverages the robustness and security features inherent to Java, ensuring a reliable and secure platform for users' financial transactions. The application architecture is designed with a focus on simplicity and efficiency, enabling farmers to easily navigate through different financial services without any technical hassles. Additionally, the use of Django for the backend ensures a seamless integration of complex banking functionalities within a user-friendly mobile interface.

Customer

Agrodigital Honduras

Duration

24 months

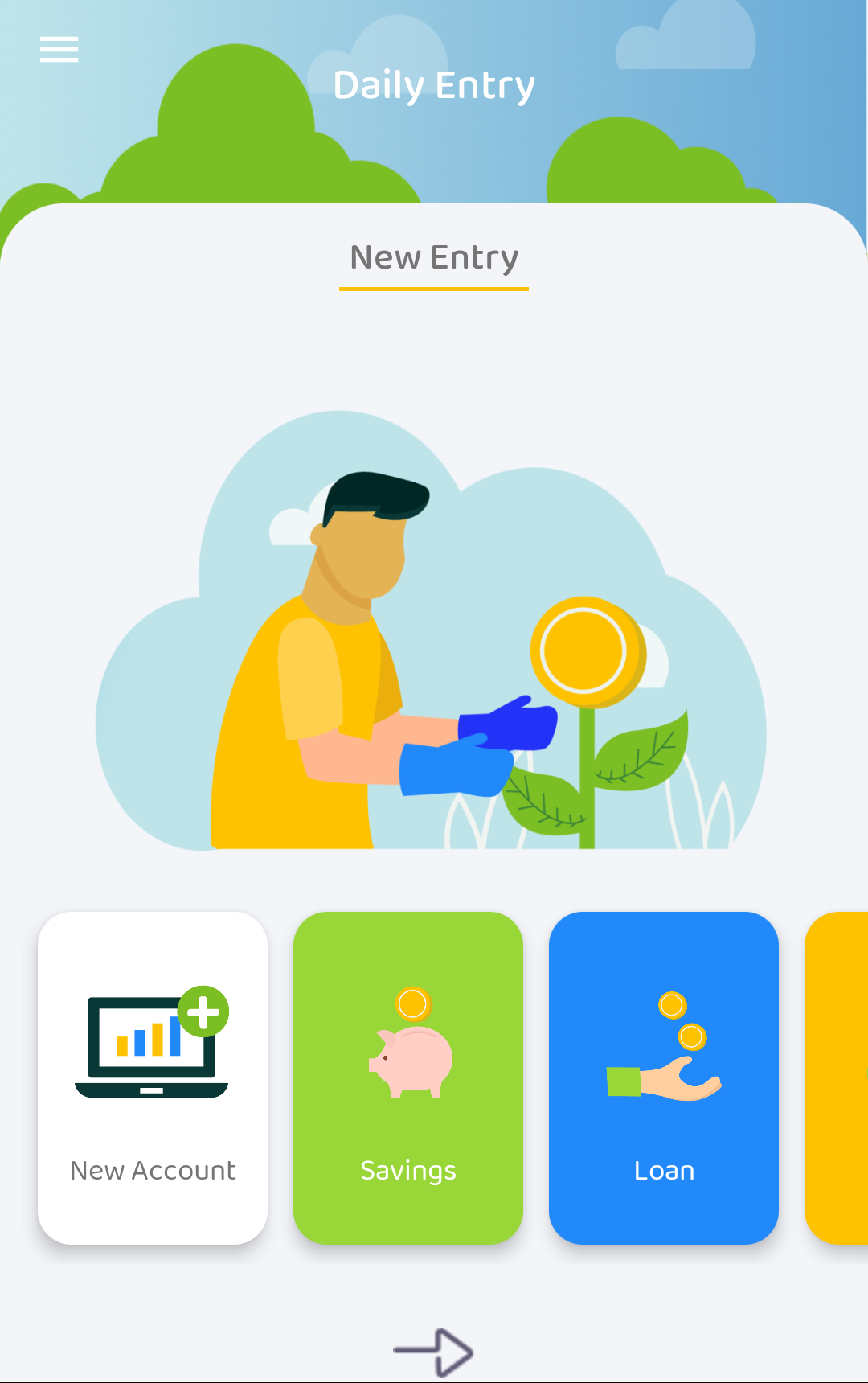

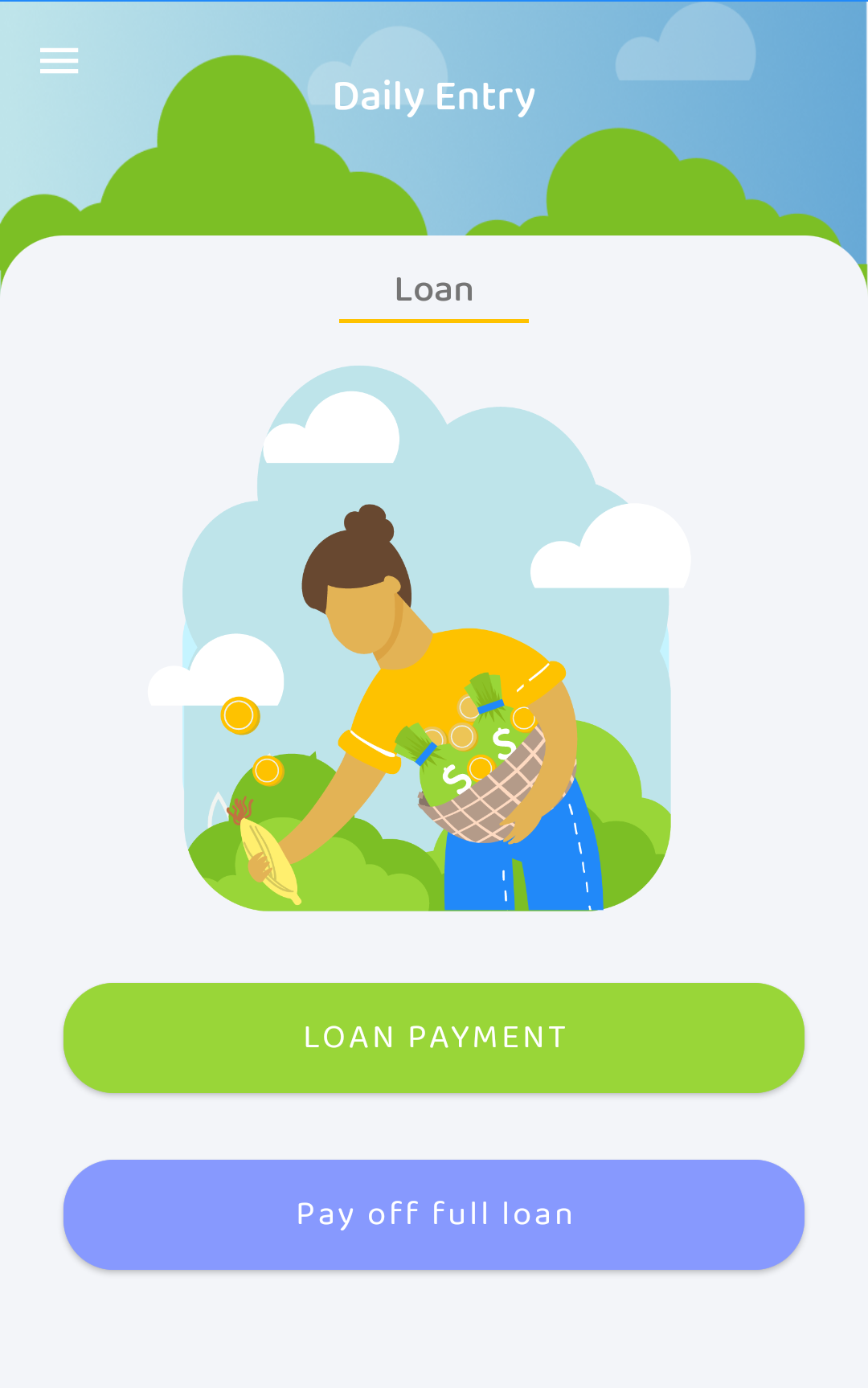

The implementation of Mi-caja is focused on creating a user-centric banking experience that meets the specific needs of the agricultural sector and the small size of the banking system in developing countries. The application supports a variety of account types, each designed to cater to the different aspects of farming investments and operations. To ensure a smooth and responsive performance, optimization techniques are applied, enhancing the efficiency of financial transactions, report analysis and data processing. This careful attention to detail ensures that farmers have access to a fast, reliable, and easy-to-use banking platform.

Developing a mobile banking application like Mi-caja for a specialized sector such as agriculture presents many huge challenges, including the need for tailored financial products and the accessibility of the app for users in rural areas. To address these challenges, Mi-caja incorporates features specifically designed for farmers, such as low-interest loans for land and plant investments. Moreover, the application is optimized for use in areas with limited internet connectivity, ensuring that farmers across Honduras, regardless of their location, can access vital banking services. This thoughtful approach to design and functionality makes Mi-caja a critical tool in the financial empowerment of the farming community.