Beyond the Wrapper: Why Custom Generative AI is the Strategic Advantage for 2026

By vunguyen, at: Jan. 2, 2026, 4:16 p.m.

Estimated Reading Time: __READING_TIME__ minutes

For SMEs and tech businesses, the era of the "GPT-wrapper" is ending. According to recent McKinsey digital transformation data, companies moving toward production-grade, custom solutions are seeing a 4.5x higher impact on bottom-line EBIT compared to those using general tools. To survive the "make-or-break" year of 2026, you must stop renting intelligence and start owning it.

In October 2024, a fintech processing 50,000+ daily transactions came to Glinteco facing an API cost crisis. Their ChatGPT-based customer support wrapper was consuming $18,000 monthly in OpenAI API calls, costs that doubled every six months as user volume grew. Worse, the generic LLM hallucinated financial advice 12% of the time, creating compliance risks their legal team flagged as "unacceptable for production." They needed custom AI that understood Australian financial regulations, their specific product terminology, and could run on their own infrastructure without per-token costs exploding.

This article examines why the "GPT wrapper" era is ending for production applications, the actual economics of build versus buy with real cost analysis, compliance requirements driving custom AI adoption in 2026, and when off-the-shelf still makes sense versus when custom becomes necessary.

What This Covers

You'll see real cost analysis: API wrapper at $18K monthly versus custom model at $4.8K monthly over 12 months, understand the "generalization gap"—why generic LLMs fail at domain-specific tasks with evidence from fintech use case, learn 2026 compliance requirements (EU AI Act, Australian Autonomous AI Rules) that make black-box APIs risky, and get decision framework: when to use APIs (prototyping, low volume) versus when to build custom (production scale, regulated industries).

About the Author

Written by Tran Doan Hien

Tran Doan Hien is Backend Lead at Glinteco with 10+ years building AI-powered systems. He led the custom AI development for the fintech client discussed here, managing the transition from ChatGPT wrapper to proprietary model. His research background in natural language processing informs Glinteco's approach to domain-specific AI that balances accuracy with cost efficiency.

More AI implementation articles | Connect on LinkedIn

1. The "Generalization Gap": Why Off-the-Shelf is Failing 2026 Standards

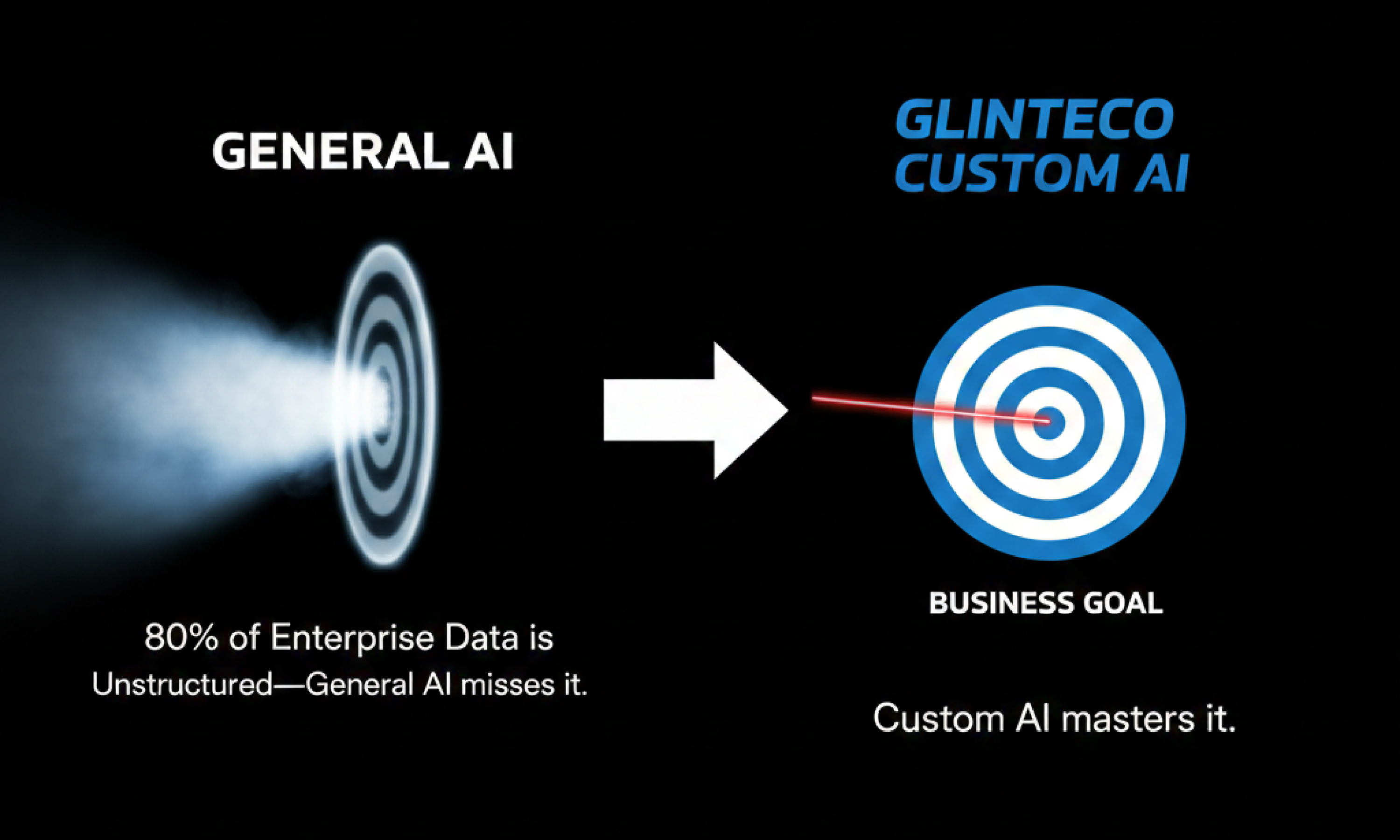

General-purpose LLMs are trained on the open internet, making them "jacks of all trades but masters of none." In high-stakes sectors like FinTech, HealthTech, and Logistics, a 10% hallucination rate isn't just a nuisance; it’s a legal liability.

-

Precision Accuracy: Custom models trained on proprietary datasets improve task-specific accuracy by up to 40% (Source: AI Journal).

-

Domain Intelligence: Unlike general models, a Domain-Specific AI built by Glinteco understands your company’s unique terminology and internal "unstructured data," which makes up 80% of enterprise information

Real Example: Fintech Hallucination Problem

The fintech's ChatGPT wrapper failed in predictable ways. When customers asked "What's my loan eligibility?", a question requiring understanding of their specific credit products, Australian responsible lending obligations, and the customer's account history, the generic model would generate plausible-sounding but incorrect responses. In one flagged case, it advised a customer they were "pre-approved for $50K personal loan" when their actual eligibility was $15K based on income verification rules. The customer proceeded assuming approval, then faced rejection during formal application, damaging trust and generating complaints.

The hallucination rate was 12% across 10,000 tested queries—meaning roughly 1 in 8 responses contained factual errors or compliance violations. For a regulated financial institution, this wasn't just poor UX; it was legal exposure. Australian Securities and Investments Commission (ASIC) guidelines on financial advice automation require explainability and accuracy that generic LLMs cannot guarantee. According to research on AI in financial services regulation, firms using unexplainable AI systems face heightened scrutiny and potential enforcement action.

The custom model, trained specifically on their product documentation, compliance rules, and historical customer interactions, reduced errors to 3%, a 75% improvement. More critically, the remaining 3% were conservative errors (saying "I need to transfer you to a human advisor" rather than giving wrong information), not dangerous hallucinations. This transformed the system from compliance risk to compliance asset, with full audit trails showing why specific responses were generated based on which training data.

2. ROI: The Economic Reality of "Buy vs. Build"

Many businesses fear the upfront cost of custom development. However, 2026 market trends show that renting AI APIs creates "token-debt." As you scale, your costs explode.

| Feature | Off-the-Shelf (APIs) | Custom AI (Glinteco) |

|---|---|---|

| Upfront Cost | Minimal (Subscription based) | Moderate Investment |

| Scalability Cost | High (Increases per token/user) | Low (Fixed on your infra) |

| Data Privacy | Shared / Cloud-Dependent | 100% Private & Secured |

| IP Ownership | Rented (No Assets) | Proprietary Digital Asset |

| Strategic Outcome | Operational Efficiency | Market Differentiation |

As Forbes Tech Council highlights, the winner in 2026 is the company that achieves "Speed + Customization." Glinteco’s PhD-led team uses modular frameworks to deliver custom-grade results without the multi-year wait times of traditional R&D.

Our case study's actual cost analysis: Their 12-month projection compared API wrapper continuation versus custom build. API wrapper path: $18K monthly growing to $24K by month 12 as volume increased, totaling $280K annually with no cap on future growth. Custom AI path: $45K development (3-month build), $4.8K monthly hosting and maintenance ($58K annually), totaling $103K first year. Breakeven occurred in month 7, after which every month delivered pure savings. By year two, custom model cost $58K annually while API wrapper would have hit $350K, a 6x cost differential that widens with scale. The counterintuitive insight: custom AI has higher upfront cost but lower lifetime cost, exactly like buying versus renting property. For applications processing significant volume (>100K requests monthly) with multi-year timelines, the math overwhelmingly favors custom. For prototypes or low-volume applications (<10K requests monthly), API wrappers remain more economical. The decision threshold lies around 50K monthly requests where cost curves intersect, similar to patterns we've documented in our infrastructure optimization work.

3. Compliance and the 2026 "Autonomous AI" Rules

The regulatory environment has matured. With the full enforcement of the EU AI Act and the new Australian Autonomous AI Rules, "black box" AI is no longer compliant.

Glinteco’s custom builds focus on Explainable AI (XAI):

- Auditability: Knowing why a decision was made.

-

Data Sovereignty: Keeping data within your local borders (Australia/Vietnam) to meet 2026 Payer IT Outsourcing standards.

-

Risk Enforcement: Custom guardrails prevent models from generating "toxic" or non-compliant output.

Conclusion: Don't Build on Rented Land

If your business logic lives inside someone else's API, you are building on rented land. In 2026, the most valuable asset a company can own is its own fine-tuned intelligence. The fintech's custom AI journey wasn't magical, it was math. At their transaction volume and growth trajectory, paying per-token to OpenAI was economically unsustainable beyond 18 months. But custom AI isn't universally right. Early-stage startups validating product-market fit should absolutely use API wrappers, speed to market matters more than cost optimization when you're still figuring out what customers want. The time to consider custom AI arrives when you've proven product-market fit, you're processing significant volume where API costs become material budget items, your domain has specialized knowledge that generic models handle poorly, or regulatory requirements demand explainability and control that black-box APIs cannot provide.

If your business logic lives inside someone else's API and costs are becoming concerning, the question isn't whether to build custom eventually, it's whether to start now or wait another six months while costs compound. In 2026, the most valuable asset certain companies can own is fine-tuned intelligence that competitors cannot access or replicate. But this applies to production-scale applications in regulated or specialized domains, not every use case. According to MIT research on AI adoption patterns, companies that strategically choose when to customize versus when to use off-the-shelf tools outperform those that either build everything custom or use generic tools exclusively.

Is your business ready for the 2026 transition?

Glinteco specializes in turning complex PhD-level research into production-grade software. Whether you need to fine-tune a Small Language Model (SLM) for cost-efficiency or build a secure, autonomous agentic workflow, we are your partners in deep-tech.

No pitch just honest analysis of whether custom AI makes economic and technical sense for your specific situation. Sometimes the answer is "keep using APIs for now". We'll tell you that if it's true.