Vertex TaxにおけるSOAPとRESTful API:シームレスな統合アプローチ

By hientd, at: 2024年11月4日10:36

予想読書時間: __READING_TIME__ 分

税務コンプライアンスに関して、サードパーティの税務サービスとの信頼できる統合は、正確な計算とシームレスなビジネス運用を確保するために不可欠です。Vertexは、主要な税務テクノロジープロバイダーであり、SOAPとRESTful APIという2つの主要な統合方法を提供しています。

この投稿では、これら2つのAPIタイプの主な違い、ユースケース、Vertex税務統合においてどちらを選択すべきかについて説明します。

SOAP APIドキュメント: Vertex SOAP API

RESTful APIドキュメント: Vertex RESTful API

SOAP vs. RESTful:基本

詳細に進む前に、SOAPとRESTful APIの違いを理解することが重要です。

-

SOAP(Simple Object Access Protocol):SOAPは、クライアントとサーバー間の通信にXMLを使用するプロトコルベースのAPIです。より複雑な操作をサポートし、エラー処理、セキュリティ(WS-Security)、トランザクション管理のための組み込み標準が含まれています。

-

REST(Representational State Transfer):RESTは、標準的なHTTPメソッド(GET、POST、PUT、DELETE)を使用し、JSON形式をサポートできるアーキテクチャスタイルです。ほとんどの統合ニーズに対して、より柔軟性が高く、軽量で高速です。

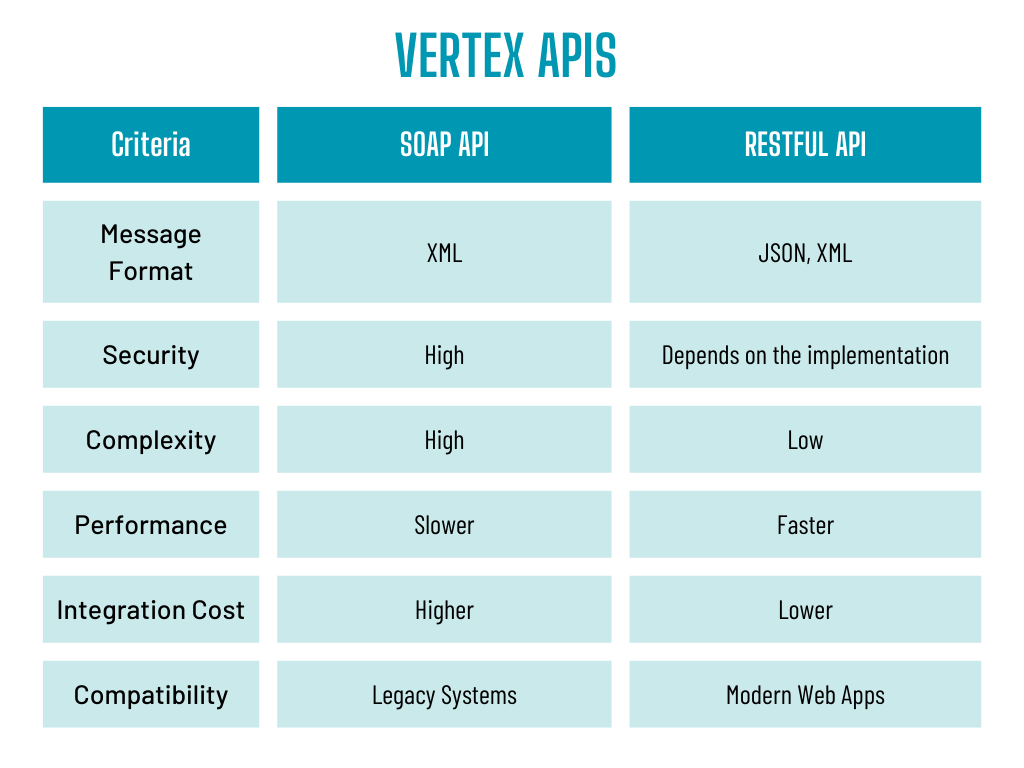

Vertex税務におけるSOAPとRESTful APIの主な違い

1. プロトコルとメッセージ形式

- SOAP API:厳格なXMLフォーマットを使用し、メッセージ全体がSOAPエンベロープに含まれているため、冗長になります。

- RESTful API:通常、リクエストとレスポンスのペイロードにJSONを使用するため、軽量で扱いやすくなります。

2. 複雑さと柔軟性

- SOAP API:非同期メッセージング、分散トランザクション、より堅牢なエラー処理などの複雑な操作向けに設計されています。

- RESTful API:より単純なタスクの実装が容易で、操作に関してより柔軟性があります。CRUD(作成、読み取り、更新、削除)操作に最適です。

3. パフォーマンスに関する考慮事項

- SOAP API:XMLフォーマットと厳格な仕様のオーバーヘッドにより、特に信頼性の低いネットワーク上では、SOAP呼び出しは遅くなる傾向があります。

- RESTful API:ペイロードが小さいため(多くの場合JSONベース)、軽量で高速であり、ほとんどの場合パフォーマンスが向上します。

4. エラー処理とセキュリティ

- SOAP API:エラー処理とセキュリティのための組み込み標準があり、セキュリティレベルの高い環境に適しています。

- RESTful API:エラー処理にはHTTPステータスコードに依存し、OAuthやHTTPSなどの追加のセキュリティ対策が必要です。

Vertex税務におけるSOAPの使用場面

SOAP APIは、次のような高度な機能が必要な場合に最適です。

- 複雑なワークフロー:複数の操作を単一のトランザクションとして実行する必要があるシナリオ。

- エンタープライズ統合:SOAPの厳格なプロトコルは、既にSOAPを使用しているレガシーエンタープライズシステムとの統合に役立ちます。

- セキュリティの強化:データセキュリティが最優先事項である場合、SOAPの組み込みWS-Securityは追加の保護レイヤーを提供します。

使用例:

トランザクションの整合性とエラー処理が重要な、大規模企業の高度な税計算を実行する場合。

Vertex税務におけるRESTful APIの使用場面

RESTful APIは、次の場合に適しています。

- 速度とスケーラビリティ:RESTの軽量な性質により、高速処理とウェブ規模のアプリケーションに最適です。

- マイクロサービスとクラウド:RESTは、マイクロサービスやクラウドベースのソリューションなどの最新のアーキテクチャとの互換性があるため、これらの環境に最適です。

- 使いやすさ:RESTful APIは、最新のフレームワークとの消費と統合が容易なため、新しいプロジェクトの選択肢として最適です。

使用例:

SOAPの厳格なルールによるオーバーヘッドなしに、すべてのトランザクションで迅速かつ頻繁な税計算が必要な、ウェブベースのeコマースプラットフォーム。

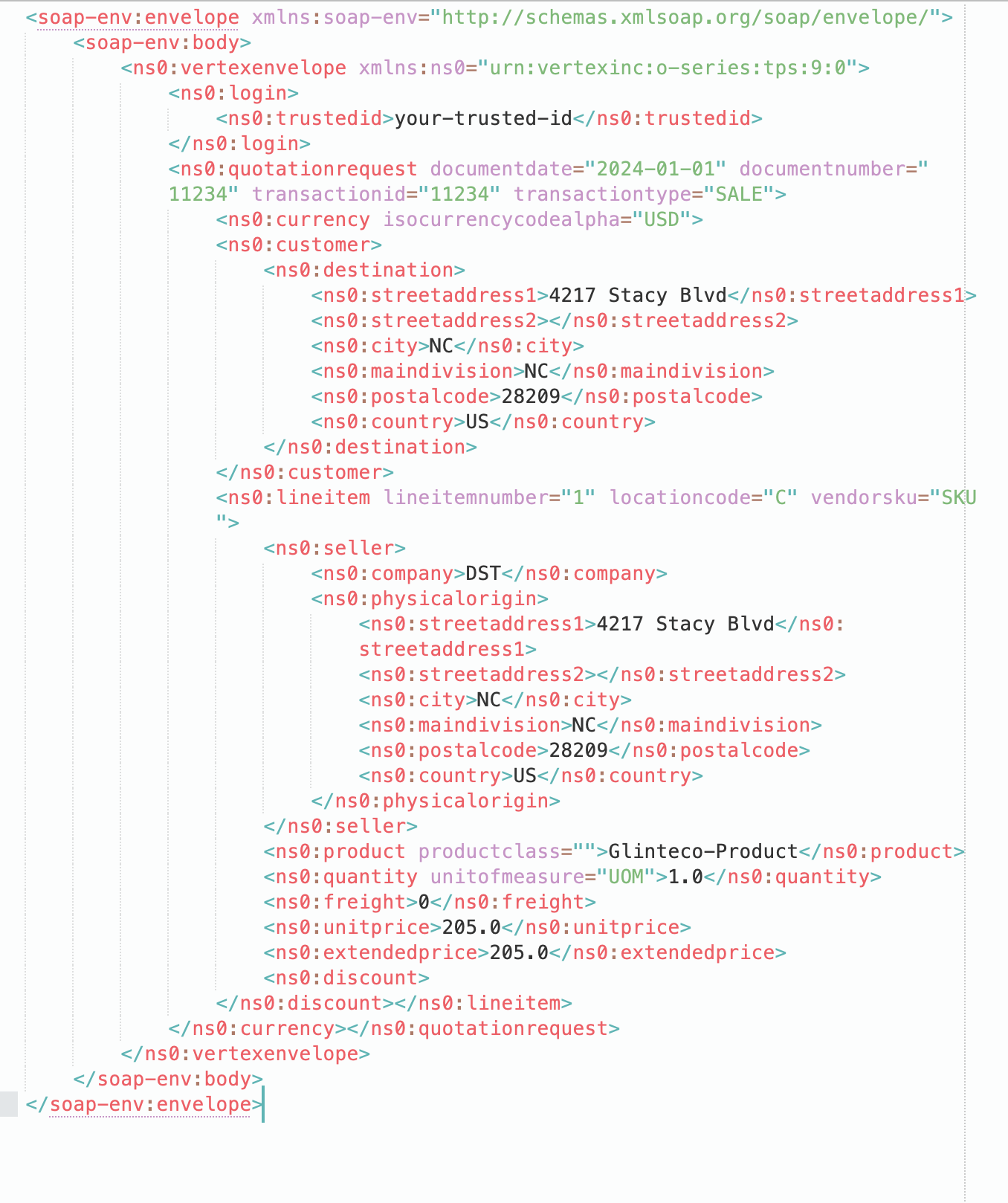

統合例:実際のSOAPとRESTful

SOAPとRESTfulのアプローチでVertex Tax APIとの統合がどのように異なるかを見てみましょう。

SOAP API統合:サンプルペイロード

RESTful API統合:サンプルレスポンス

{

"customer":

{

"id": "CUST12345",

"businessLocation":

{

"country": "US",

"postalCode": "10001"

}

},

"lineItems":

[

{

"product":

{

"code": "PRD001"

},

"quantity": 2,

"unitPrice": 100

}

],

"currency": "USD",

"transactionType": "sale"

}

Vertex税務におけるSOAPとRESTful APIの長所と短所

SOAP API

長所:

- 堅牢なセキュリティ:WS-Security標準を組み込み、セキュリティレベルの高い環境に適した高度なセキュリティ機能を提供します。

- 包括的なエラー処理:エラー処理とトランザクション管理のための組み込み標準により、信頼性が向上します。

- エンタープライズ互換性:複雑なワークフローとレガシーエンタープライズシステムとの統合に最適です。

短所:

- パフォーマンスのオーバーヘッド:SOAPエンベロープ内のXMLフォーマットを使用するため、メッセージサイズが大きくなり、パフォーマンスが低下する可能性があります。

- 複雑さ:厳格なプロトコルと冗長なメッセージングにより、実装とメンテナンスが複雑になる可能性があります。

RESTful API

長所:

- 軽量で高速:通常、データ交換にJSONを使用するため、ペイロードが小さくなり、処理速度が向上します。

- 柔軟性:より単純なタスクの実装が容易で、CRUD(作成、読み取り、更新、削除)操作に適しています。

- 最新のアーキテクチャとの互換性:マイクロサービスやクラウドベースのソリューションとよく連携します。

短所:

- セキュリティに関する考慮事項:エラー処理にはHTTPステータスコードに依存し、OAuthやHTTPSなどの追加のセキュリティ対策が必要です。

- 組み込み機能の制限:SOAPのような高度な機能(組み込みトランザクション管理など)がありません。

ユースケース:

- SOAP:強力なセキュリティ、トランザクション管理、または既存のエンタープライズシステムとの互換性が必要なシナリオに最適です。

- RESTful:シンプルさ、速度、最新のウェブアーキテクチャとの互換性を重視するアプリケーションに最適です。

結論:適切なアプローチの選択

SOAPとRESTful APIのどちらを選択するかは、プロジェクトの特定のニーズによって異なります。

- 強力なセキュリティ、トランザクション管理、またはエンタープライズシステムとの互換性が必要な場合は、SOAPを選択してください。

- シンプルさ、速度、および最新のウェブアーキテクチャとの互換性を重視する場合は、RESTfulを選択してください。

これらの違いを理解することで、Vertex税務サービスをより効果的に統合し、ビジネスニーズに合わせたシームレスで効率的なソリューションを提供できます。